Succession Planning

You’ve planned everything for years. Now it’s time to begin thinking about what’s next. Most business owners don’t want to run their operation forever. The vast majority of entrepreneurs don’t plan for the inevitable. Nearly 85% of business owners we’ve met over the last 25 years don’t have a well-developed exit strategy and can miss out on maximizing their asset value without proper organization and planning. In today’s ever-evolving global business arena, the importance of meticulous asset management and comprehensive estate planning has never been more immediate. Whether they’re seasoned entrepreneurs or aspiring visionaries, business owners pour years of dedication and hard work into cultivating their enterprises. Ensuring the seamless transfer and protection of these assets is not merely a financial consideration but a testament to the impact on everyone involved. Planning now for the future to include contingency planning review, tax exposure mitigation, along with charitable and inheritance giving plans, will eliminate a number of transactional questions amongst an abundance of unknowns.

Essential Tools for Business Owners

Estate planning is an essential tool for safeguarding the fruits of one’s labor. By diligently implementing estate planning measures, business owners can rest assured that their assets will be distributed according to their wishes. Whether it’s a family business passed down through generations or a burgeoning startup poised for exponential growth, clarity in asset distribution is vital.

Clarity

Estate planning offers the opportunity to precisely define beneficiaries, eliminating any ambiguity or potential disputes. By clearly delineating beneficiaries, business owners can mitigate conflicts and facilitate a smooth transition of ownership. This clarity not only serves the interests of the business but also fosters harmony within families and organizations.

Succession Planning with S+P

- Transition

- handover

- working with us

Options

There are a myriad of options to begin the potential business exit succession discussion. Do we look to bring on a partner to help facilitate growth via majority recapitalization? Do we sell internally, do we bring on additional management to take the majority shareholder(s) out of the day to day, or do we shut down operations and call it a day? Our team at S+P Capital Partners will take the guesswork out of the conversation and help create foundational solutions to maximize your business value as you continue to grow and expand.

Removing the Unknowns

An often-overlooked aspect of estate planning is the establishment of a decision-making framework for unforeseen circumstances. None of us can predict the future, and the possibility of incapacitation due to illness or injury must be acknowledged. Through proactive estate planning, individuals can designate trusted individuals to make decisions on their behalf, ensuring the safeguarding of both assets and well-being.

Sustainability

Moving from estate planning to long-term succession, the principles of foresight and experience remain paramount. Long-term succession planning extends beyond individual ownership to ensure the sustainability and resilience of the organization itself. It is a strategic imperative that requires meticulous attention to detail and a forward-thinking approach.

Minimize Disruption

Critical to effective succession planning is the identification of key positions within the organizational hierarchy. These positions serve as the linchpin of operational continuity, and their seamless transition is vital for business resilience. By identifying potential vacancies and mentoring successors, organizations can mitigate the risks associated with leadership turnover.

Adaptable and Innovative

Equally crucial is the assessment of essential skills and anticipation of future employee performance. In an era marked by rapid technological advancements and evolving market dynamics, adaptability and innovation are essential. Long-term succession planning demands a thorough understanding of the skills and competencies that will drive future success, enabling organizations to stay ahead of the competition.

Tailored Approach

Here at S+P Capital Partners, we understand the multifaceted challenges confronting businesses in today’s dynamic landscape. With a proven track record of assisting businesses across all stages of the lifecycle, we recognize that while each organization is unique, there are foundational principles that drive success. Through our tailored approach to estate planning and succession, we are dedicated to helping businesses navigate complexity and secure a prosperous future.

Determining Value

Business valuation consists of multiple variables linked to an excess of variances and every business owner should know what their businesses are worth for a myriad of reasons. It’s a baseline from which all other opportunity develops. We provide detailed metrics based on your empirical data, recent comparable sales, and a series of industry metrics defined by folks in your trade. In addition, we’ll work with you to develop a “range of value,” along with proper forecasting, determining critical metrics for growth, and identifying any missing key business components.

Get Stronger

Long term succession planning strengthens any organization. Establishing critical positions and highlighting potential vacancies, determining critical skills and future employee performance necessary for business continuity, and focusing on individual and group development to meet future business needs are all components of long-term planning that need immediate and regular attention. It takes foresight and experience to build out a succession plan. We’ve worked with businesses at every stage of the business life cycle and understand that although each business’ needs are unique and specific, there are certain standards which we’ve found are universal. We’ll make sure those foundational standards are solidified while we help plan for succession.

The S+P Capital Difference

Industry Experience

Real world deal experience. We’ve spent the last 25+ years incrementally improving our processes while working on hundreds of sell side transactions in just about every industry.

Skilled Investment Banking Professionals

Investment bankers must understand deal mechanics and nuance. You can’t have one without the other. The mechanics are black and white blocking and tackling. Nuance separates the most talented investment bankers from the masses. We understand the emotional ebb and flow this process will create and what obstacles are in our path. We’ll guide you and walk side by side from before the beginning to well after our mission is complete.

Process Driven Outcomes

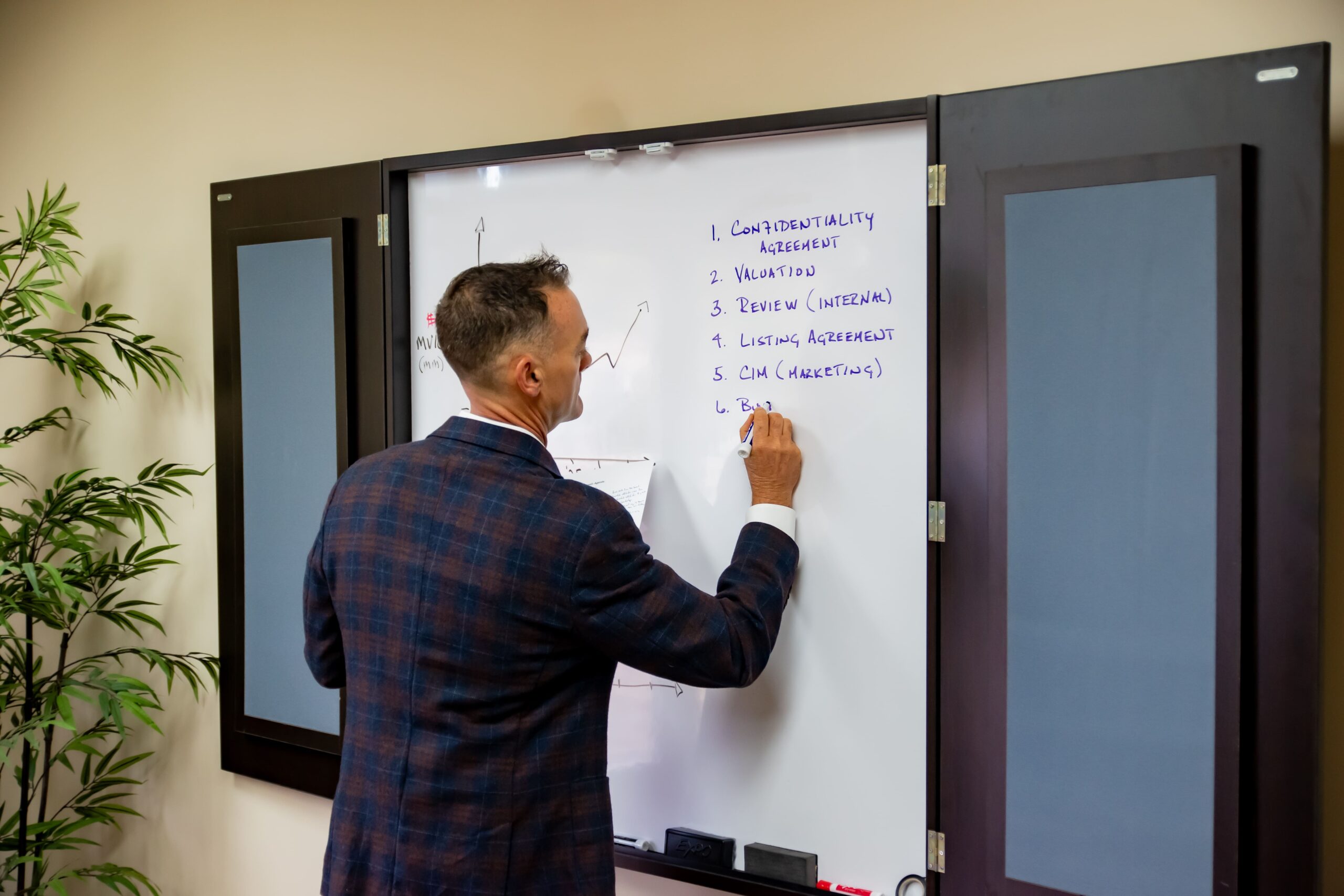

We don’t haul and hope. We’ve developed very specific and customized deal processes in every industry we’ve completed transactions. We don’t offer a cookie cutter assembly line process. Our team creates bespoke processes from valuation, to marketing, to acquisition target identification, to transaction, to close, and beyond. We don’t take shortcuts, we’re diligent and persistent, and our process is transparent from the very start.

Going into this process we had no idea what all was involved, however, I cannot recall a single problem. I am sure this was due to the professionalism of you and your staff. We would be happy to recommend your services to anyone buying or selling a business.

Business Owner at Light Manufacturing Business

Est. 1904 – Sold to Strategic Company

Industries We Serve

S+P Capital Partners offers investment banking services, specifically sell-side advisory services to privately held businesses and business owners. We deliver efficient, trustworthy, and experienced Merger and Acquisition services to businesses with up to $150 million in enterprise value. With nearly 40 years of deep-learned, real world deal experience, we understand how transactions work before they start through after they close.

Healthcare

- Outsourced Services

- Clinics & Practices

- Pharmacy Services

- Healthcare IT, Devices, & Equipment

- Wellness

- Managed Care Services

Industrial Services

- HVAC, Plumbing, Electrical

- Waste Management

- Roofing

- Construction & Engineering

- Fire Safety & Control

- Pest Control

- Janitorial Services

Business Services

- Marketing Services

- Legal Services

- Education & Training (equipment, proprietary educational materials)

- Insurance

- IT Managed Services

- Business Process Outsourcing

- Simulation & Training

- Human Capital

Consumer

- Beauty products (and services)

- Personal Services

- Home Services

- eCommerce & Retail

- Media & Entertainment

- Wholesalers

- Private Label

- Fitness & Wellness

Manufacturing

- Logistics

- Advanced Manufacturing

- Contract Manufacturing

- Producers & Processors

- Supply Chain

- Suppliers & Distributors

- Paper & Packaging

- Industrial